Equipment Finance Finance Finance → Vendor Vendor Vendor Programs → Asset Based Lending

Empowering Growth Through Smart Financing

Calqulate provides tailored financial solutions to help businesses scale efficiently while preserving capital. Our expertise in Equipment Finance, Vendor Programs, and Asset-Based Lending ensures you have the resources to invest in critical assets without compromising liquidity or ownership.

Seamless Financing for Limitless Growth

SOLUTIONS

Equipment Leasing

Empower your business with equipment financing to preserve working capital, extend cash runway, and minimize equity dilution. Ideal for companies with essential equipment needs and significant CapEx requirements to scale operations.

Vendor Programs

Strategic partnerships between equipment vendors and financing companies allow customers to access flexible payment options for purchasing equipment. These programs are designed to help vendors close more deals, shorten sales cycles, and improve customer satisfaction by offering tailored financing solutions.

Asset Based Lending

Our flexible asset-based lending solutions support businesses at every growth stage.

BENEFITS

Benefits of Equipment Leasing

- Flexible Access to Capital

Draw funds exactly when you need them, ensuring agility and efficiency. - Extended Cash Runway

Enhance financial stability with financing that complements equity and debt options. - Targeted Financing

Secure equipment-specific funding without affecting existing credit arrangements. - Hardware-as-a-Service

Finance revenue-generating, customizable equipment tailored to your business needs

Benefits of Vendor Programs

- Increased Sales Flexible monthly payment options make high-cost equipment more affordable, enabling larger purchases.

- Comprehensive Financing Covers 100% of costs, including equipment, installation, training, and freight.

- Accelerated Sales Cycle Streamlined financing reduces decision-making time, helping vendors close deals faster.

- Enhanced Customer Loyalty Providing financing solutions fosters long-term relationships by easing financial constraints.

- Improved Cash Flow for Customers

Enables businesses to acquire essential equipment without hefty upfront expenses.

Competitive Edge – Stand out from competitors by eliminating cost barriers and making purchases more accessible.

Benefits of Asset Based Lending

- Increased Liquidity Unlock working capital by leveraging assets such as receivables, inventory, and equipment, improving cash flow for day-to-day operations.

- Flexible Financing ABL adapts to business growth, allowing companies to access more capital as their assets increase.

- Preserve Equity Unlike equity financing, ABL enables businesses to secure funding without diluting ownership.

- Faster Access to Capital Compared to traditional loans, ABL provides quicker funding with fewer financial covenants, making it ideal for companies needing immediate liquidity.

- Agricultural Equipment

- Construction

- Information Technology

- Life Sciences

- Robotics

- Semiconductors

- Transportation

- Manufacturing

- Real Estate

- Aerospace

- Printing & Packaging

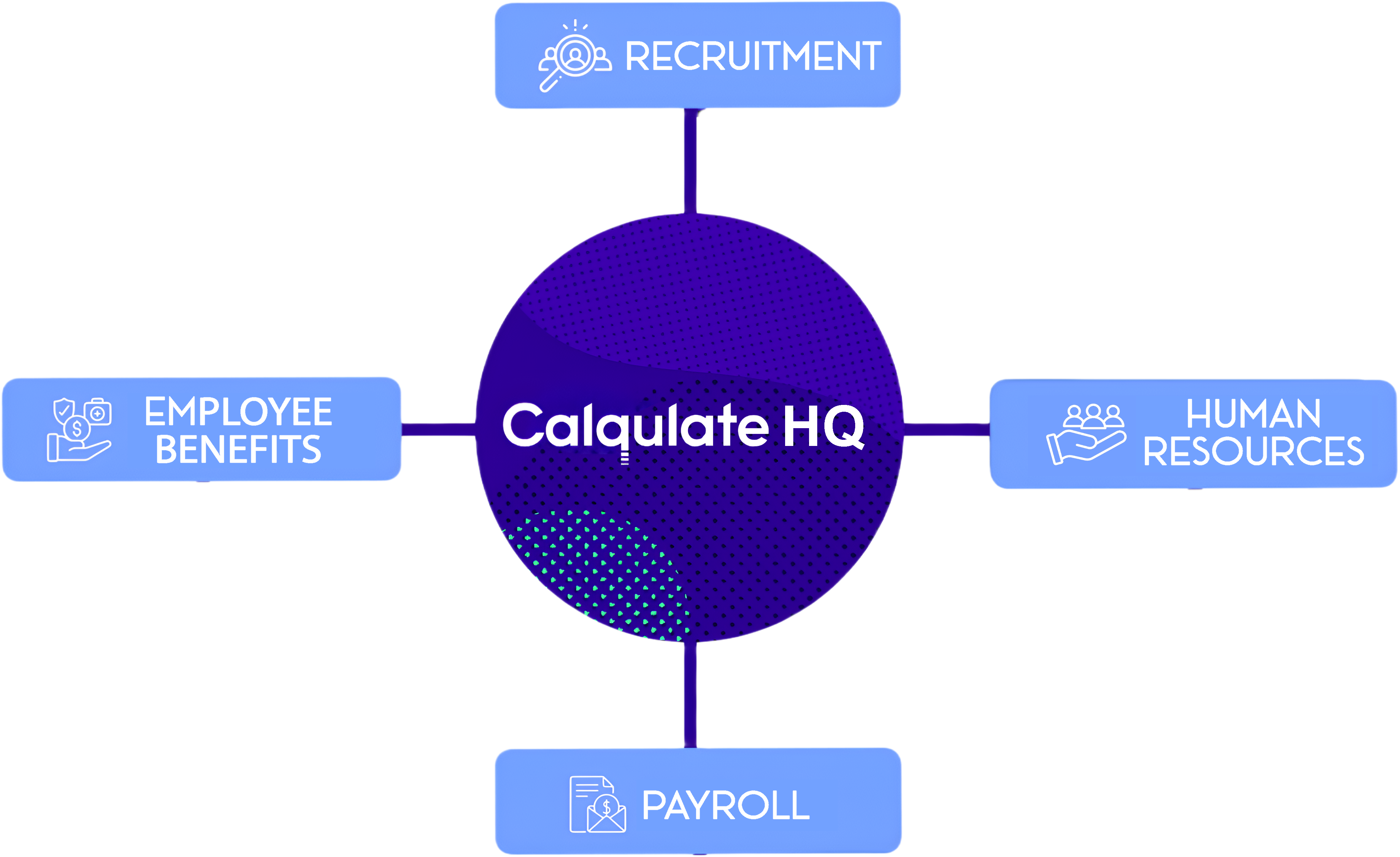

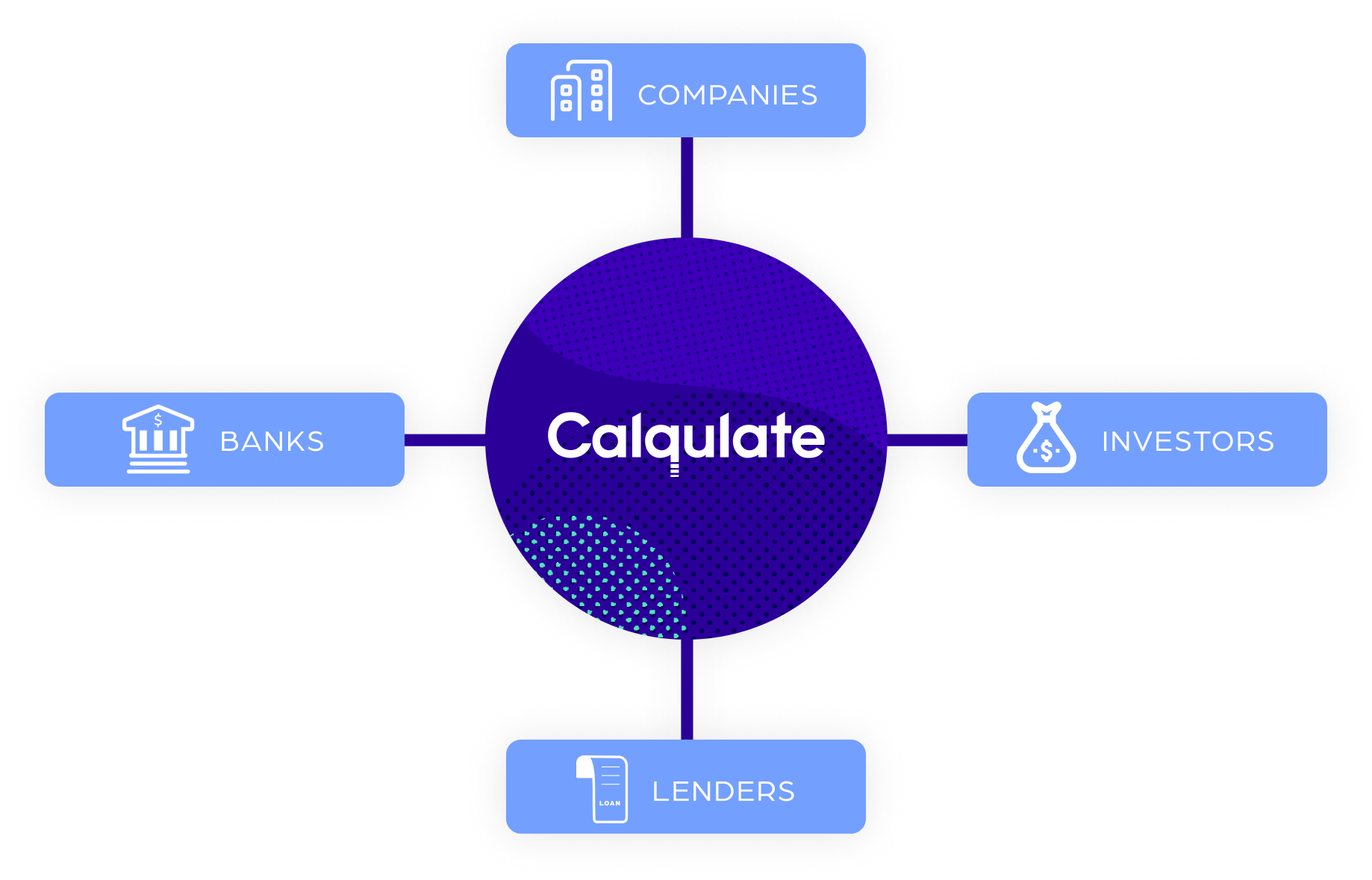

Our Ecosystem