Metrics, KPIs and Financial Forecasting for SaaS Businesses

SaaS businesses are inherently scalable and most SaaS entrepreneurs want to grow their businesses exponentially. Growth is built into the SaaS business model, and almost all professional SaaS investors expect significant month-on-month revenue growth and strong traction before they are willing to invest into a new SaaS venture. Closing new deals and getting new customers require investments in sales and marketing, growth hacking and considerable amount of financing due to high customer acquisition expenses. Sales and financial forecasting consist of several elements, and in order to get it right, sales funnel analysis of a SaaS company needs to be extended to include revenue forecasting, customer lifecycle analysis, staff planning and cashflow forecasting. Putting all the pieces together has traditionally taken a lot of time, money and effort, often resulting in having to use several different software, or massive Excel files that are error-prone and time-consuming to update.

Calqulate’s mantra – financial reporting automation

Calqulate founders and employees have worked with a number of tech and IT companies over the years, and we’ve seen several financial reporting packages that have been created by a team of data analysts, CFOs and controllers, that have taken a considerable amount of time to create. Many reporting packs have lacked some of the basic features that are needed to have 360-view to the financial operations of a SaaS business, and most of them have been time-consuming to update on a daily, weekly and monthly basis. Financial forecasting has always caused a headache for entrepreneurs, and the lack of predictability and transparency can be really frustrating. This leads us to believe that in the field of financial reporting and forecasting there is room for improvement and automation. Calqulate’s financial reporting and forecasting articles will help you learn how to track and maximize the growth of your business in a financially stable and transparent way, making sure you always know how much financing is needed to achieve the growth targets. Accurate forecasting will improve your chances of making the right decisions.

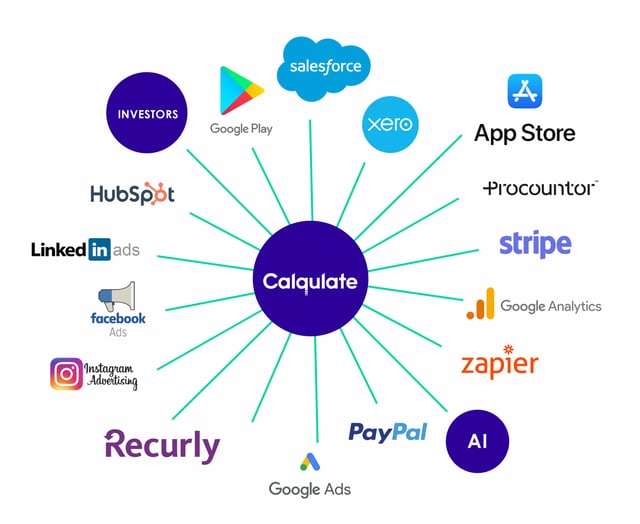

Calqulate’s software and reporting models cover the whole process from data sources to metrics, data visualization, forecasting, cashflow forecasting and reporting to various parties, such as management, board and investors, whereas most of the other tools in the market concentrate only on one step of the process (for example SaaS metrics software), or are only relevant to one the above mentioned parties (for example investor reporting software). Calqulate is currently the only company that incorporates efficient and accurate forecasting to all metrics and visualizations. We believe financial reporting should be clear, readily out-of-the box, visual and elegant, and we want to remove the stress and ambiguity of financial reporting. Our goal is to make sense of your data and make financial reporting more fun. And it should be understandable for non-financial people. Unlike anybody else, we want to make enterprise financial reporting tools and models accessible and affordable to SMEs. In this article series we will start with the basics and move onto more detailed guides topic by topic.

Why bother with forecasting?

Forecasting simply sets your organization to the right track and helps you make better decisions. The goal is not to get forecasting 100% accurate, but to get in the ballpark with as little resources and workload as possible. Forecasting can be viewed as setting targets, making incremental changes along the way and tracking development. If you set clear and realistic targets you are much more likely to achieve your goals.

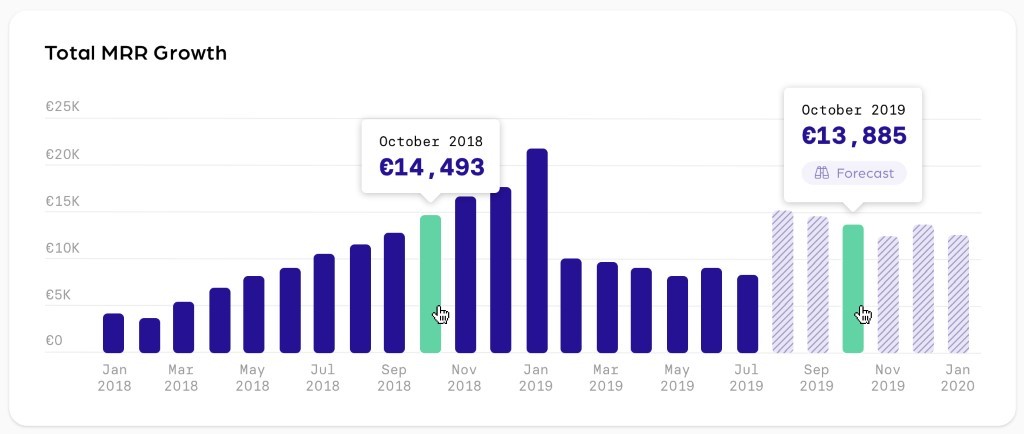

One of the most important things with financial reporting and forecasting is to start with identifying the Key Performance Indicators (KPIs) of your company. Many people use the terms KPI and metric interchangeably, but there is quite a difference between these two terms. Every KPI is a metric, but not all metrics are KPIs. Almost anything that can be counted can be a metric but it does not mean it has any relevant impact on how your business is performing. KPI means a quantifiable measure to evaluate the success of a company, and forecasting should mostly be based on KPI targets. There are dozens of SaaS metrics that different corporate departments should be analyzing on a daily basis, for example website traffic, clicks and marketing analytics, and the management team of a SaaS company should know the high-level development of most of these metrics month-by-month, but there are only a handful of KPIs that truly define the success of a SaaS company. These KPIs vary from one company to another, and they especially vary during the lifetime of the company. Early stage companies are mostly looking at the number of customer accounts, MRR growth and account growth month-on-month because they do not have a lot of data or history yet. More mature companies are expanding into new markets, calculating customer acquisition costs and lifetime value of customers per product and market, and trying to decide when is the right time to scale and accelerate growth by investing into sales and marketing. We will cover all the necessary metrics and KPIs of different development stages in our article series, and will give practical examples how to use these KPIs in sales and financial forecasting.

Which data sources are relevant for metrics and forecasting?

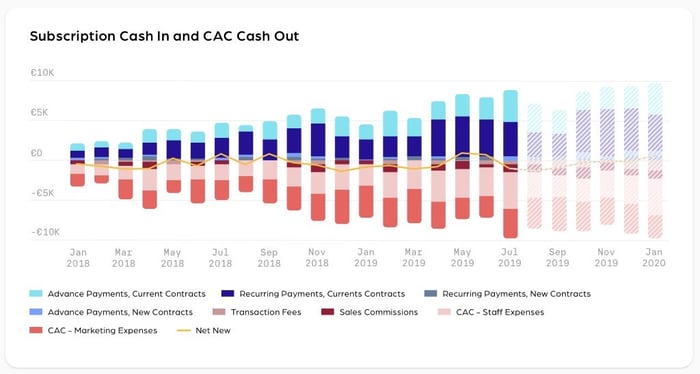

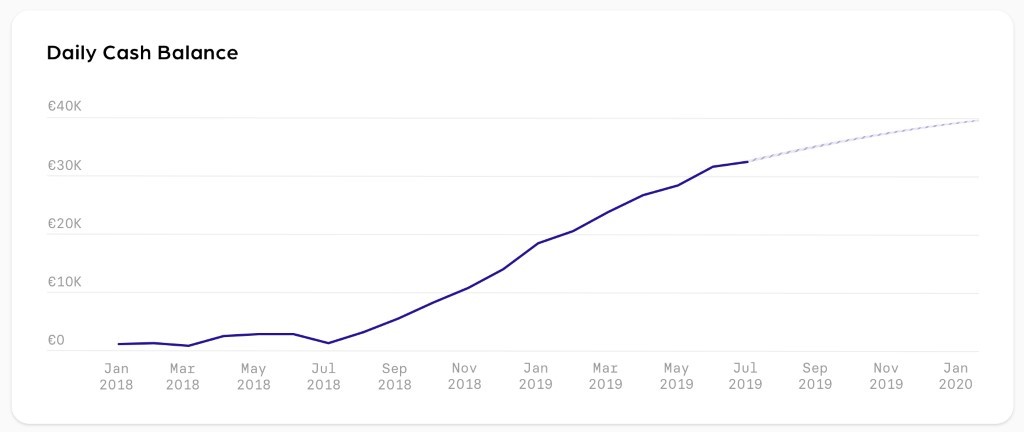

By aggregating data from several sources, you can for example track and analyze the whole lifecycle of a customer from sales funnel analysis, acquisition, revenue and lifetime value, and calculate customer profitability and sales channel profitability. KPIs for all relevant operations (marketing, sales, subscriptions and finance) function as drivers for financial reporting, revenue forecasting and cashflow forecasting, and in order to calculate and track these KPIs it is necessary to consolidate data from various sources. Stand-alone KPIs for each operation is important, but much more added value is created by creating a logical chain of KPIs from each operation to the next one (marketing to sales, sales to new customer acquisition, and to revenue and cashflows).

Forecasting should be based on historical data, always making sure that every single KPI is pointing to the right direction in the forecast. SaaS and subscription metrics and KPIs always need to have a backward and forward view to be fully meaningful and lead your company to the right direction. Forecasting does not need to be 100% accurate, but it is essential to set KPI targets, measure past performance against previous forecasts, and identify the weak links and inefficient processes in the organization in order to achieve the desired growth goals. Calqulate’s KPI’s and forecasting models follow the bottom-up approach and are built of detailed and transparent elements so that you know on a daily basis how your business is performing.

In particular, business KPIs from different services, including Payment Service Providers (Stripe, Paypal), helpdesk software, CRM software and marketing platforms, should be secured by feeding data onto one single data analytics platform. You can gain more insights, analyze customer and distribution channel profitability and save significant amount of working time by having all your analytics and consolidating all your data sources in one place. Growth forecasting should not concentrate on just revenue forecasting but should also incorporate sales funnel analytics, cashflow forecasting and booking forecasting. We will cover all these topics more in detail in future articles.