What is net profit?

Net profit is whatever you’ve earned or lost after deducting all expenses from your total revenue. In this lesson, we’ve mentioned that there are several ways to measure your company’s profitability. You can use your:

- Gross margin: Your overall gross margin gives you an idea of your production costs in relation to your revenue. It helps you figure out how to grow your revenue faster than your production cost and how to build a scalable business.

- Net profit: Your net profit gives you an idea of the money you have left after you’ve paid all expenses, loan interests, and amortized your assets.

- EBITDA: Your EBITDA gives you an idea of your ability to generate cashflows and your company’s operating performance. It takes into account operational expenses ONLY that are necessary to run your business.

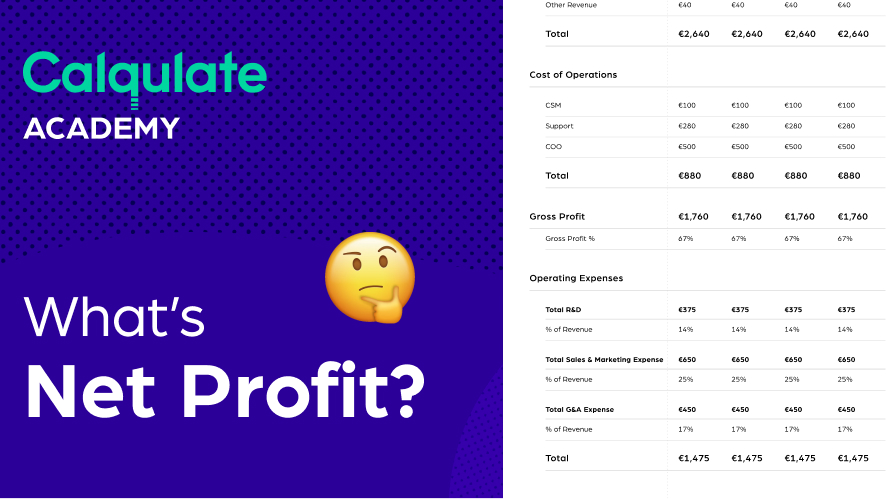

How to calculate your net profit?

The formula to calculate your net profit is very straightforward. You only need to subtract your company’s total expenses from the total revenue.

Total revenue - Cost of Sales - Operating Expenses - Other expenses - Interest - Taxes = Net profit.

For example, assuming your variables are as such:

Total revenue = $10,000,000

Cost of Sales (COS) = $3,100,000

Operating expenses (OpEx) = $2,560,000

Other expenses = $100,000

Interest = $550,000

Taxes = $2,400,000

Your net profit is:

$10,000,000 - $3,100,000 - $2,560,000 - $100,000 - $550,000 - $2,400,000 = $1,290,000

What can your net profit tell you?

Your net profit is a direct indicator of your company’s profitability because it tells you the total earnings your company has. You can make adjustments to different areas to increase your net profit. Easy peasy.

Example A:

Let’s assume that you’ve decided to decrease your OpEx by renting a smaller office. All other variables remain the same.

Total revenue = $10,000,000

Cost of Sales (COS) = $3,100,000

Operating expenses (OpEx) = $1,980,000

Other expenses = $100,000

Interest = $550,000

Taxes = $2,400,000

Your net profit with a lower OpEx is:

$10,000,000 - $3,100,000 - $1,980,000 - $100,000 - $550,000 - $2,400,000

= $1,870,000

You may wonder: Can I increase my net profit by closing more deals, i.e., increasing revenue?

Yes and no. Increasing the total revenue doesn’t necessarily mean your net profit will grow simultaneously as well. Unless...all other variables remain the same, and you don’t have additional expenses incurred.

However, that is not often the case. Let’s take a look based on Example A:

Assuming your total revenue increases to $12,000,000, and all other variables remain the same. Your net profit is:

$12,000,000 - $3,100,000 - $1,980,000 - $100,000 - $550,000 - $2,400,000

= $3,870,000

Chances are, other variables will change too – especially your taxes as well as Marketing and Sales!

An increase in Marketing and Sales costs means you’ll now have higher operating expenses. That is completely normal because you need to spend money to make money.

Assuming you now have more payable taxes after increasing your total revenue. Apart from that, you also need to hire two more customer support specialists to handle support requests. Your variables are as such with these changes:

Total revenue = $12,000,000

Cost of Sales (COS) = $4,030,000

Operating expenses (OpEx) = $2,376,000

Other expenses = $100,000

Interest = $550,000

Taxes = $2,880,000

Your net profit is:

$12,000,000 - $4,030,000 - $2,376,000 - $100,000 - $550,000 - $2,880,000

= $1,470,000

| Example A | Example B | |

| Total revenue | $10,000,000 | $12,000,000 |

| COS | $3,100,000 | $4,030,000 |

| OpEx | $1,980,000 | $2,376,000 |

| Other expenses | $100,000 | $100,000 |

| Interest | $550,000 | $550,000 |

| Taxes | $2,400,000 | $2,880,000 |

| Total net profit | $1,870,000 | $2,064,000 |

Based on the above comparison, it does seem like a higher total revenue (Example B) does yield a higher net profit. But is that true? The answer’s in your net profit rate.

Net profit rate

Like all the other metrics we’ve talked about, we never look at any of them in isolation. Your metrics are related to each other. Let’s start by looking at your net profit rate. The formula to calculate your net profit is:

Net profit / Revenue = Net profit %

For example, if you have a net profit of $1,870,000 and a total revenue of $10,000,000, your profit rate is:

$1,870,000 / $10,000,000 = 18.7%

Is that a healthy rate? It depends. What constitutes a healthy net profit rate depends on who you talk to and in which stage your company is in.

We’ll continue to build on the above comparison. Assuming the variables are as such:

| Example A | Example B | |

| Total revenue | $10,000,000 | $12,000,000 |

| Total net profit | $1,870,000 | $2,064,000 |

| Net profit rate | 18.7% | 17.2% |

Despite Example B yielding a higher total revenue and net profit, it still has a lower net profit rate.

One thing to know for sure, your net profit rate plays a huge role in your company’s health indicator known as ‘The SaaS rule of 40’. Essentially, your growth rate and profit rate should add up to at least 40% to be considered a healthy business.

For example:

- If your company is growing at 10%, you should be generating a profit of 30% to be considered healthy.

- If your company is growing at 40%, you could be generating a profit of 0% and still be considered healthy.

- If your company is growing at 60%, you could lose 20% in profit and all is still fine.

- If your company is growing at 50% but losing a profit of 30%, then something needs to be improved. For example, consider Increasing growth by 20% or reducing CAC to increase profitability.

- If your company is growing at 30% and generating a profit of 20%, then you are onto something – that’s great!

Go deeper: The rule of 40 – Lord of the ratios.

Key takeaway:

Revenue is great. Revenue is what you want to keep your business going. But growing revenue doesn’t always translate into more profit because there will be an increase in Marketing and Sales costs in order to generate more revenue.

However, that isn't always the case. Your aim is to lower your Customer Acquisition Costs (CAC) per new customer as much as you can. High growth SaaS companies tend to have very high total CAC because it is money that is paid out immediately to acquire new customers. And it takes time to start generating revenue from this investment – give or take after one to three months.

That said, it is normal for high growth companies to be making net profit losses as they amp up Marketing and Sales efforts (which translates into cost, cost, cost!). Despite that, their COS may still be considered healthy. As a benchmark, the average spend for your Marketing and Sales costs is approximately 48% of your revenue and for high-growth companies it can be much higher.

Go deeper: The ins and outs of Operating Expenses (OpEx)

Your metrics can tell you so much about your business. Avoid looking at them in isolation. While your net profit is a great indicator of your company’s profitability, there are instances where it is alright to sacrifice your net profit first.

For example, you could make a quick calculation of your Lifetime Value (LTV) to CAC ratio. The ideal ratio for a growing SaaS business is more than 3:1. You could also take a look at your CAC payback time. Ultimately, you should be aiming for a CAC payback time of less than 12 months.

If both metrics are looking healthy, then sacrificing your net profit is justified. Because when your company’s growth starts slowing down, you should start seeing an increase in your net profit as your customer acquisition costs go down.

Happy Calqulating!