Portfolio Reporting for Investors

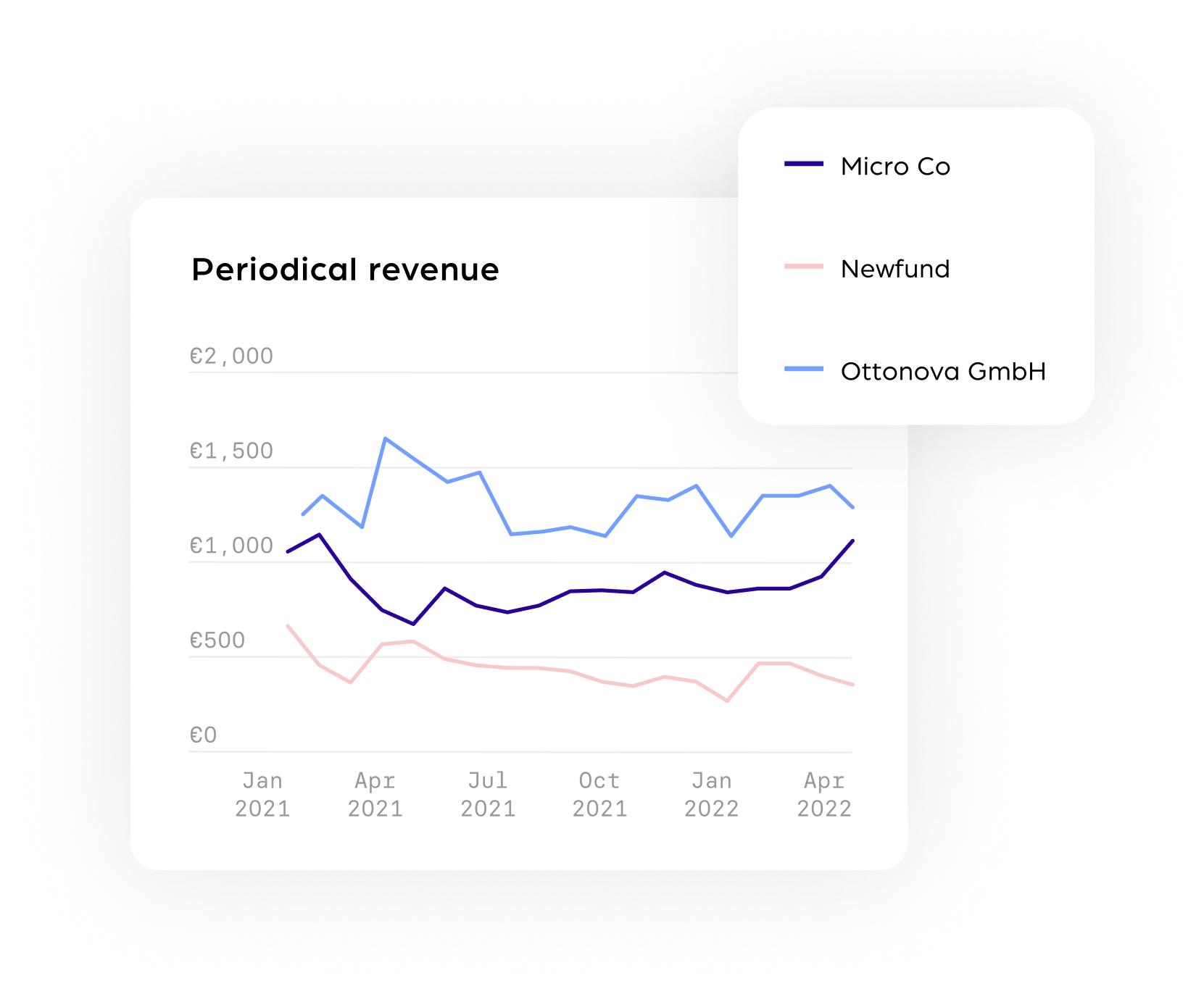

Get a real-time view to your portfolio companies' financial performance.

Financial reporting can be really complex. Calqulate automates financial analytics for startups and makes data sharing with investors simple. Keep up to date on the financial performance of your portfolio companies - in real time.

Standardized financial data for all portfolio companies

Tired of getting late and unstructured financial reporting from your portfolio companies? We thought so. Did you know it doesn't have to be this way?

Calqulate is a financial data platform that provides standardized and reliable financial KPIs for any small and medium-sized enterprise across multiple countries and verticals.

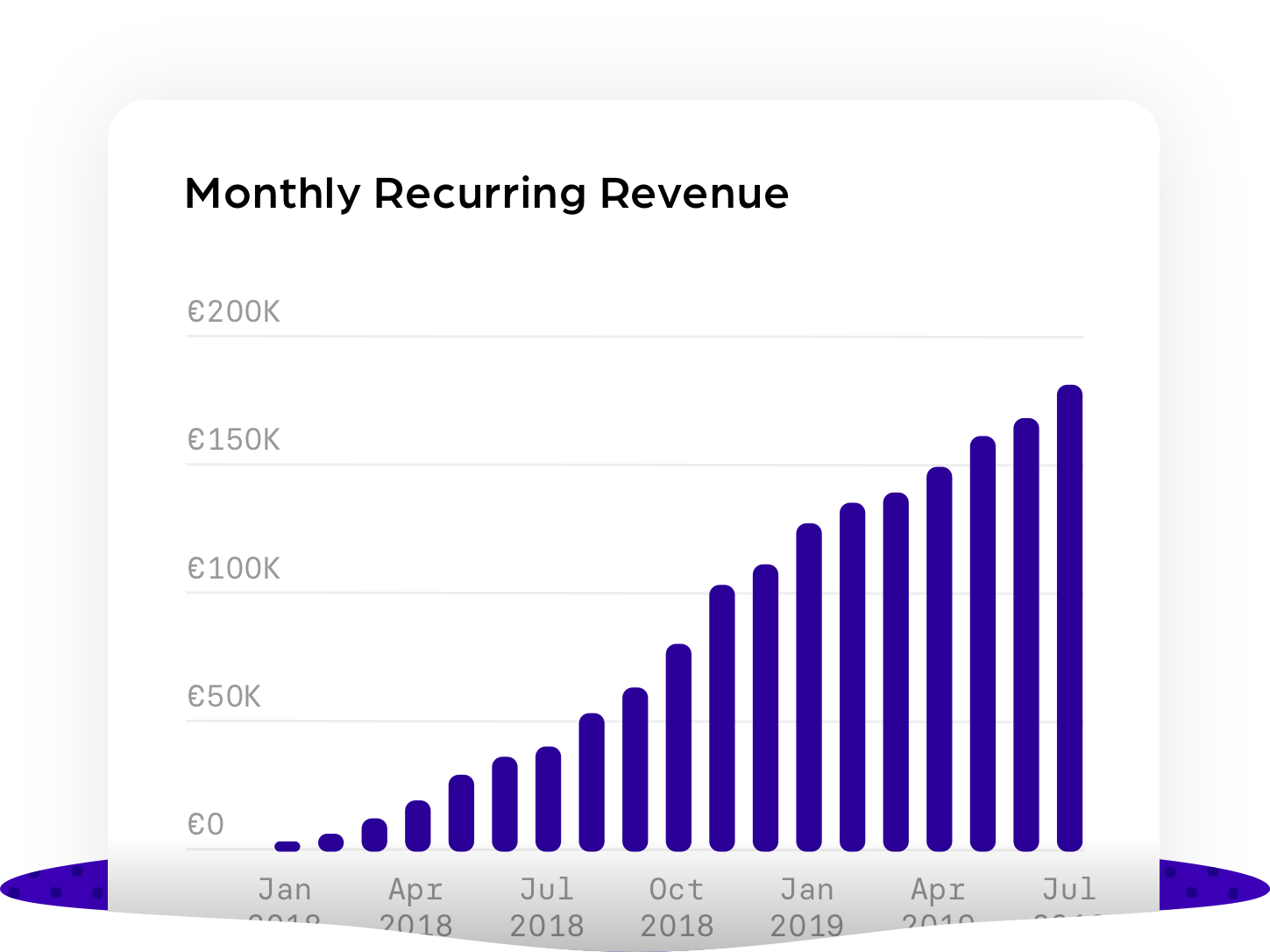

Traction Analysis in 15 minutes

No more waiting. Traction analysis in 15 minutes with hourly data syncs across the finance stack as well as real-time KPIs on available cash, MRR and Gross Margin.

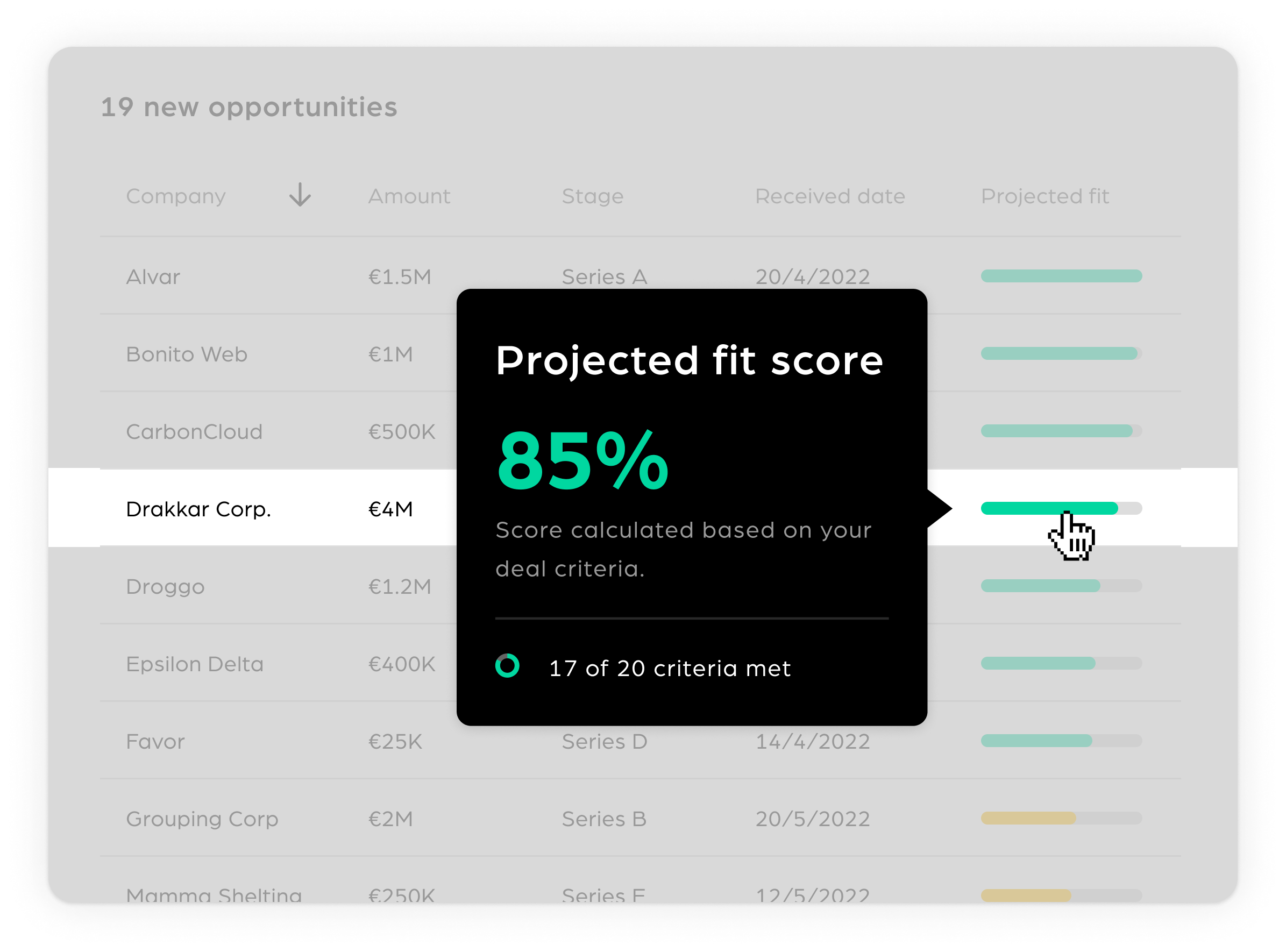

Opportunity Score

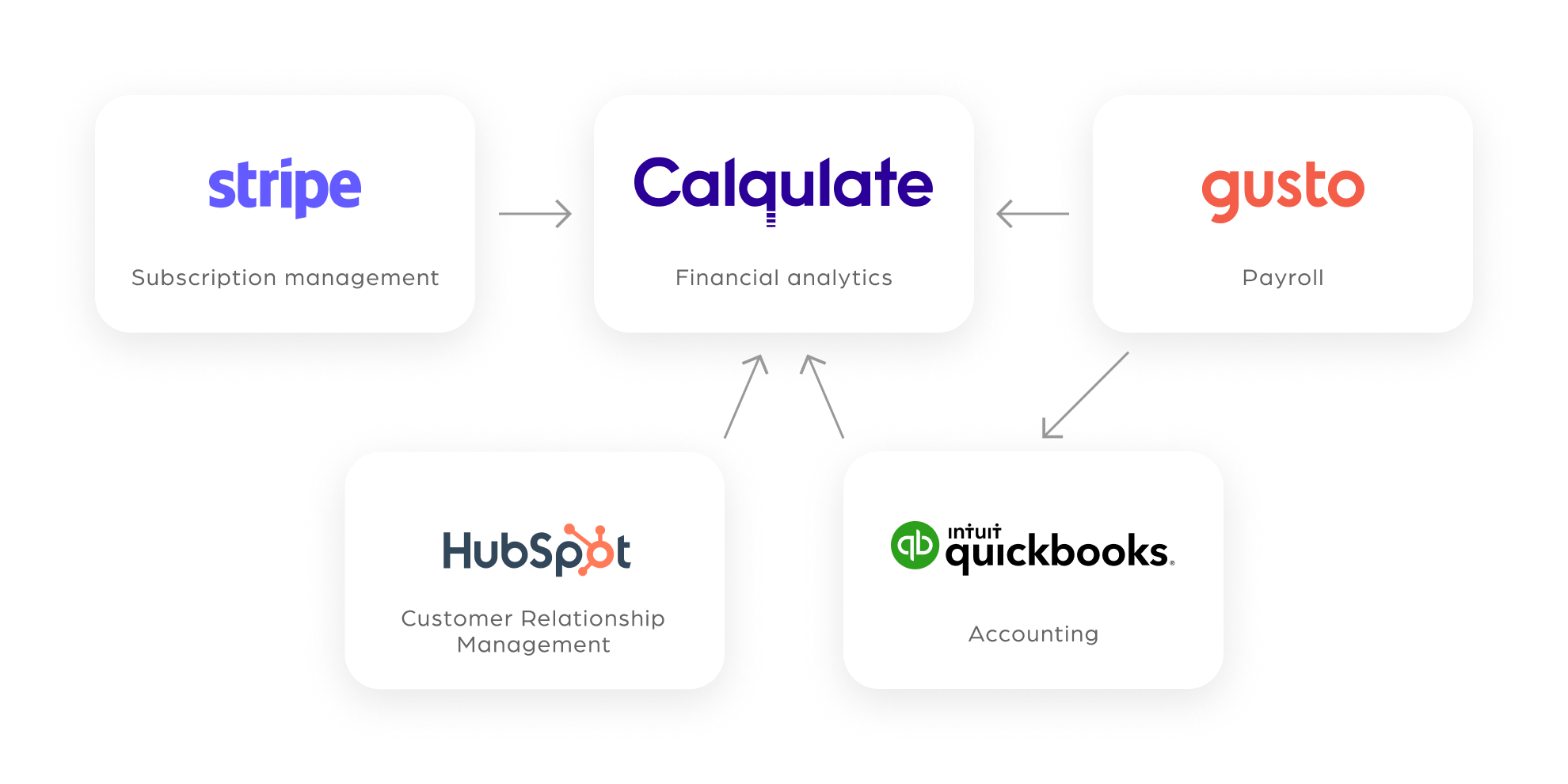

Calqulate imports financial data directly from the bank, payroll, accounting, subscription, payment and CRM systems. We match this data against your investment strategy so you spot the most promising prospects first.

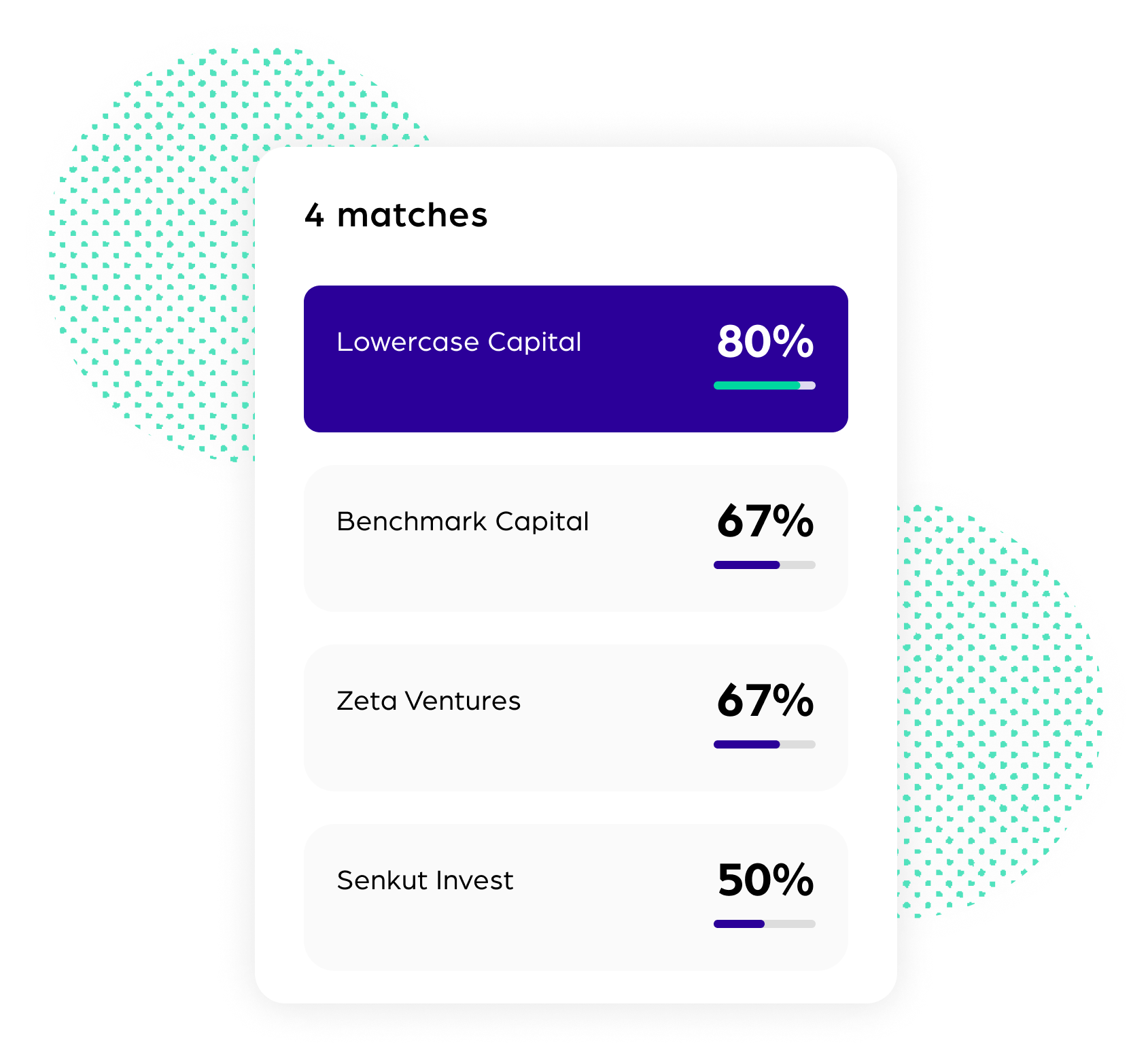

Syndicate Matchmaking

Find other suitable investors and close rounds faster. With our projected fit score, which is based on standardised financial data, it's easier to communicate openly and honestly with other investors. Help your portfolio companies reach their next funding round faster.

Zero Effort Onboarding

We handle the messy part for you.

Calqulate connects to the most popular financial software through plug-and-play integrations.

Onboarding a new company takes as little as 15 minutes, and you can get started with your new investor environment in as little as 30 minutes.

Become a financial analytics expert

A clear view of a company’s performance is becoming less of an art and more of a science. Head over to the Calqulate Academy to learn about 5 types of financial analytics that will help you follow a company’s trajectory closely and minimise your risk.