Calqulate's Assess

Assess is used by investors and lenders to make a 360° financial analysis of startups and SMBs. Calqulate standardizes financial data from 100s of data sources so that you can compare apples to apples when assessing target companies.

Standardised Financial Data

Calqulate unifies financial data from 100s of data sources and standardizes it into financial KPIs - for any country, vertical and currency. Real-time financial data to make important decisions faster.

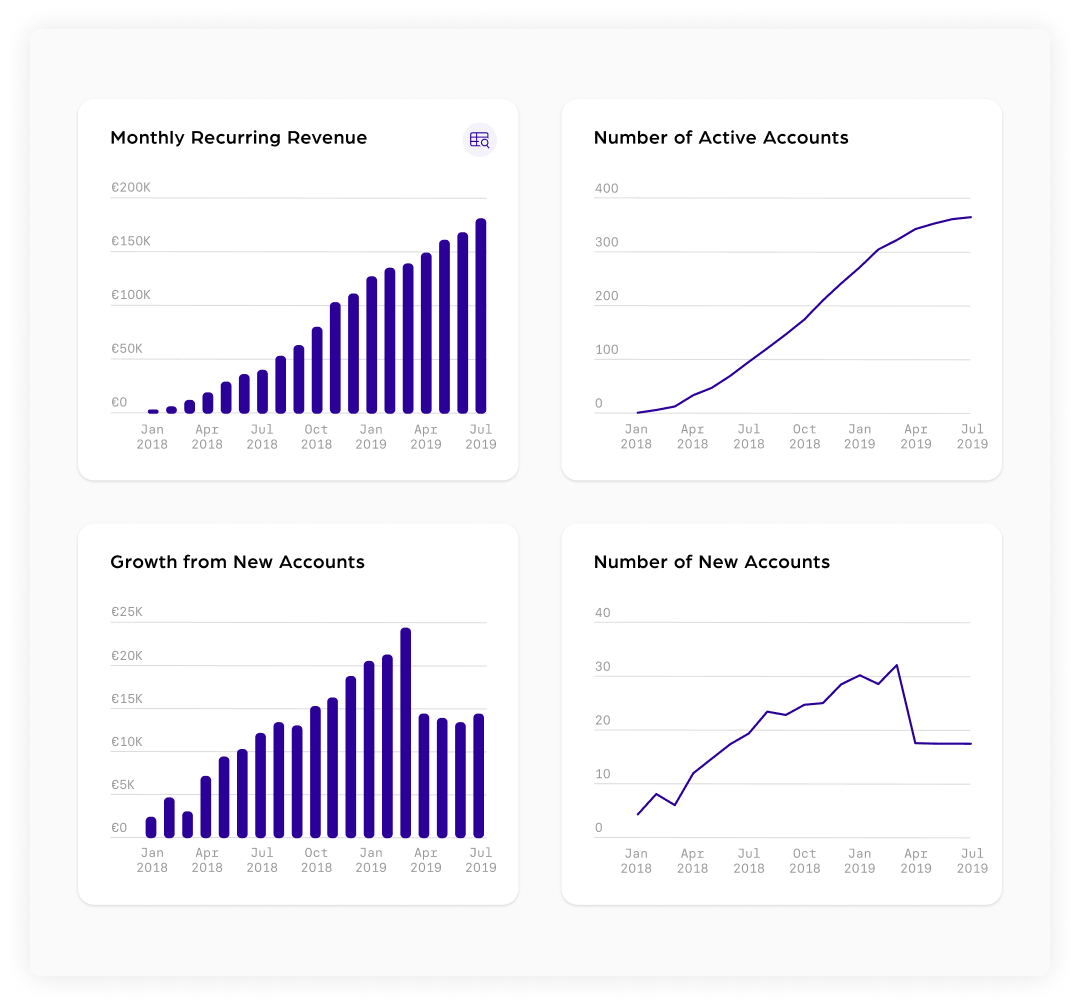

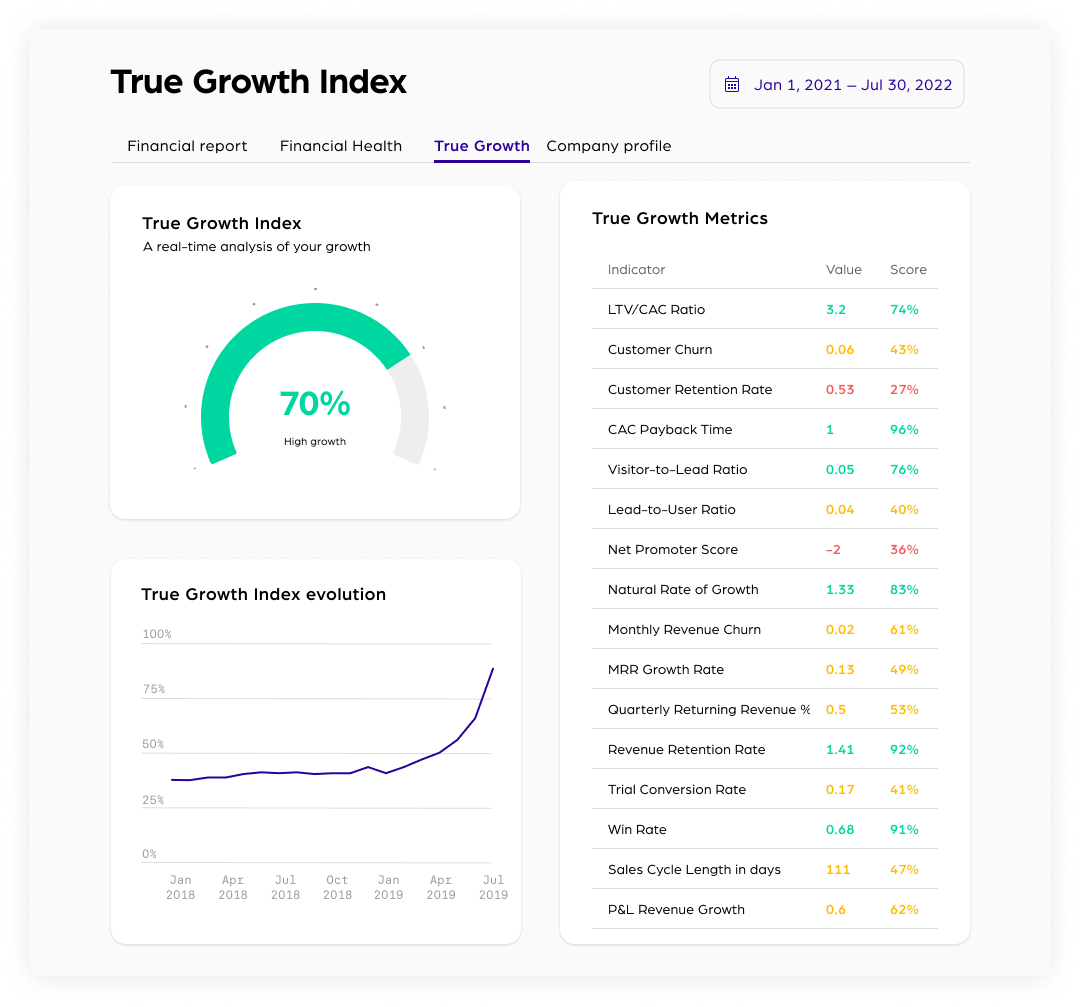

Traction Analysis for investors

Access real-time financial insights on cash runway, revenue, growth metrics and profitability with real-time data coming from a company’s financial data sources. No more waiting on ad hoc manual reports.

Loan Underwriting for lenders

Get instant credit risk analysis of small and medium-sized companies. Includes liquidity, profitability and revenue KPIs with real-time financial data. Minimise your exposure to risk and expand your deal flow.

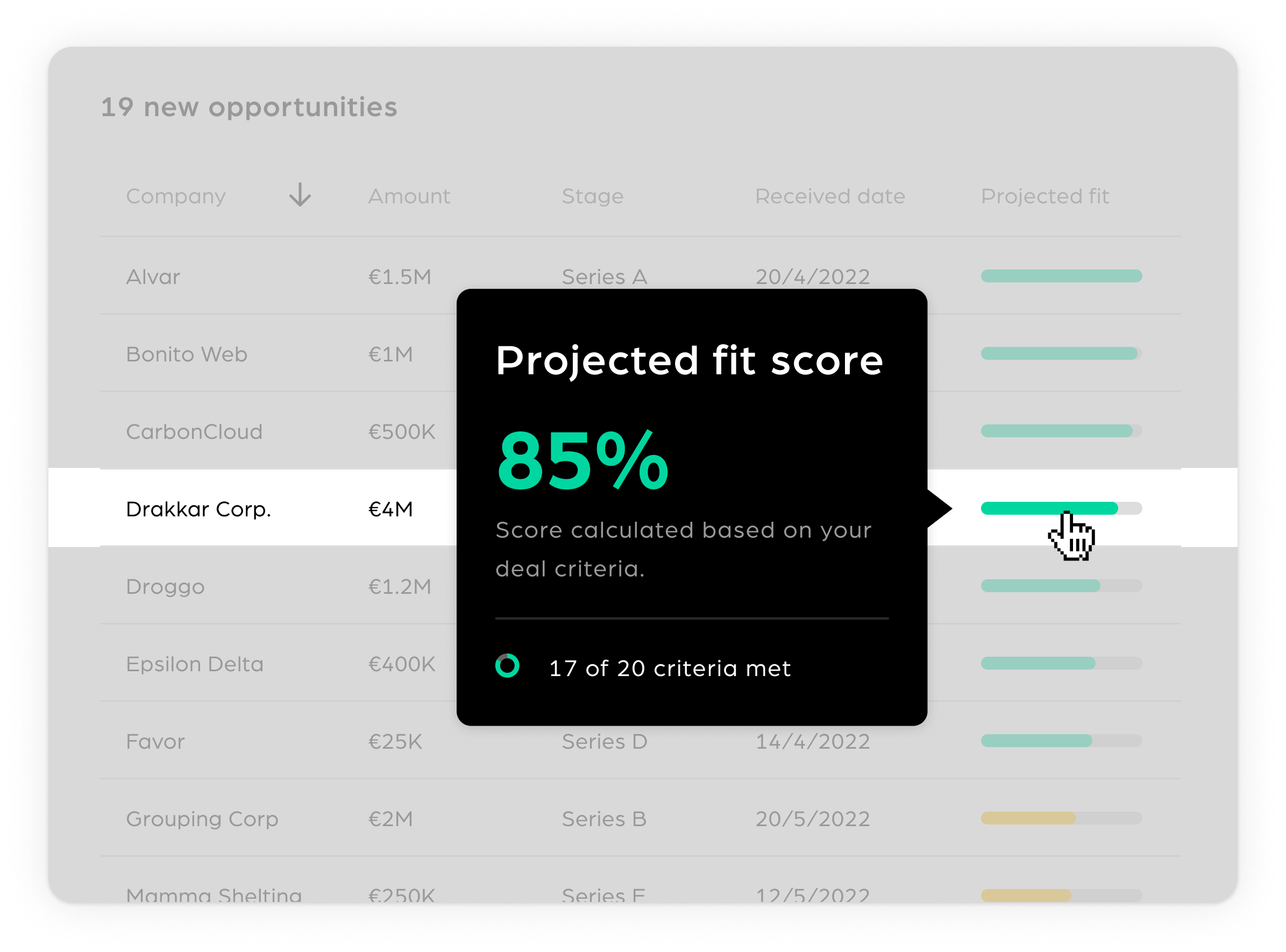

Opportunity score

Calqulate imports financial data directly from the assessed company’s bank, payroll, accounting, payment and CRM systems. We match this data against your deal criteria so that you can close the best deals faster and process more deal flow.

Multiple pipeline entry points

Inbound opportunities or outbound prospecting? Connect your deal flow to Calqulate, or assess companies that are further down the pipeline. You choose the most suitable entry point.

Calqulate API and User Interface

Calqulate's powerful API lets you export derived financial KPIs to your own database - all in standardized format. You can also use Calqulate's user interface to view financial data in elegant charts.